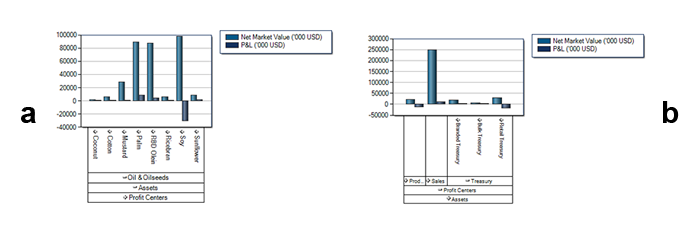

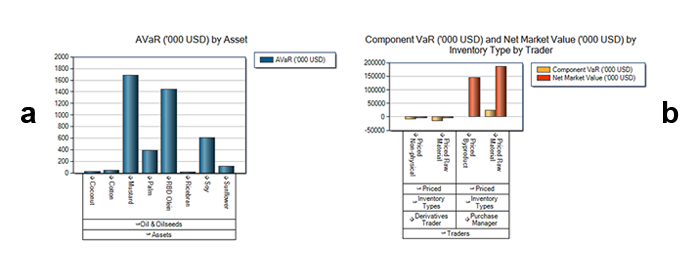

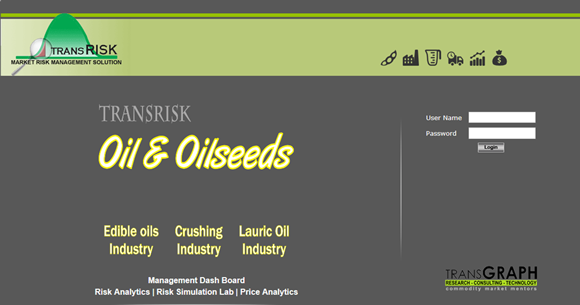

Oil & Oilseeds

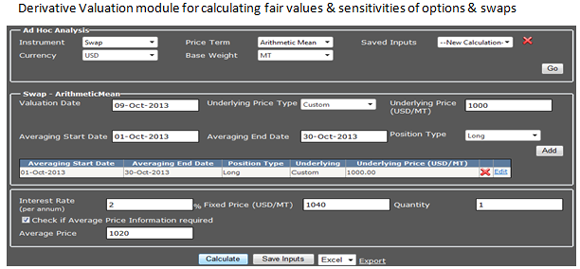

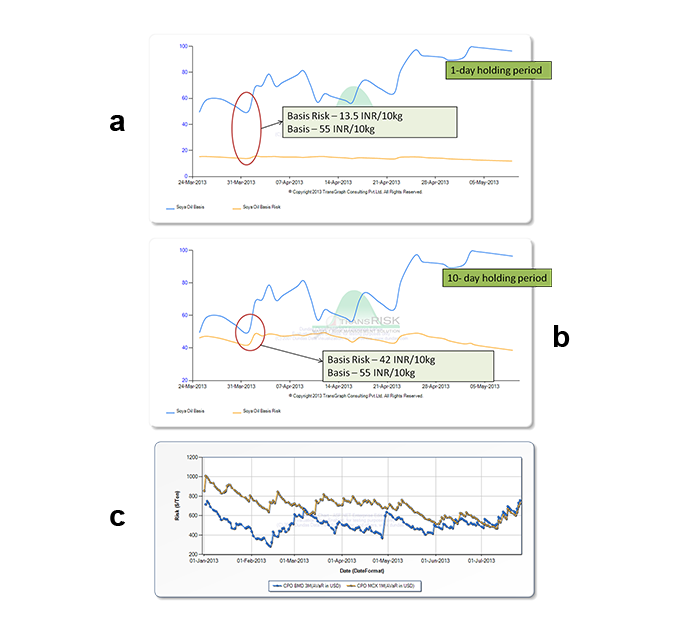

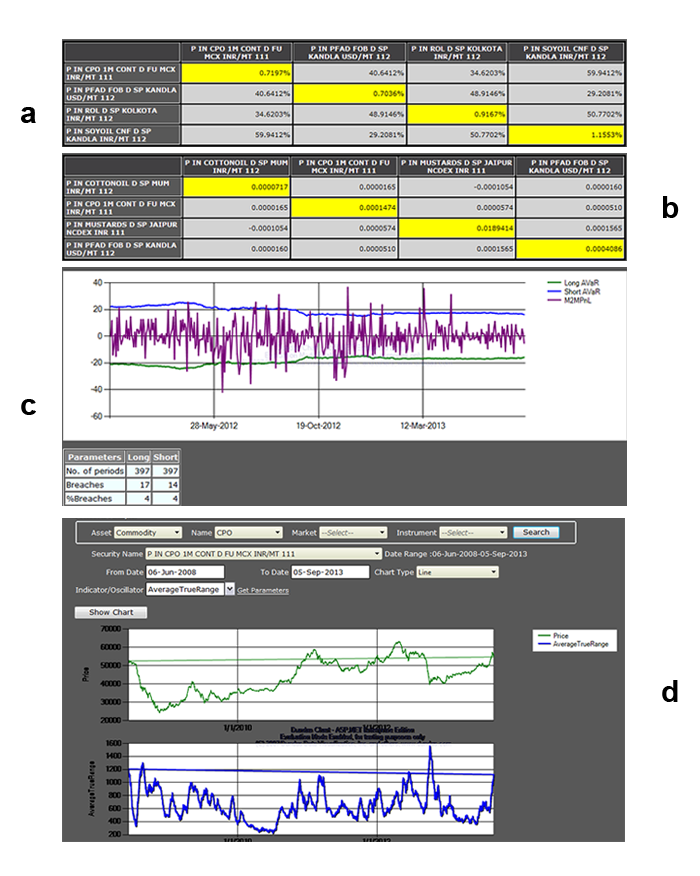

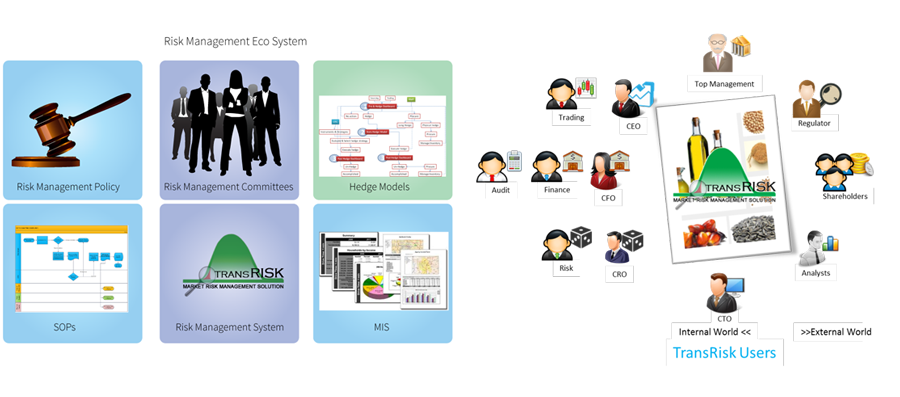

A tailor made ready-to-use solution built specifically taking the needs of oil and oil seeds industry into consideration. Being it be crush business, plantations, refining business, speciality fats or oleo chemical business addresses most of the market risk management needs.

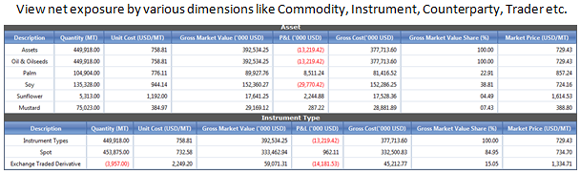

TransRisk comes with flexibility to monitor the business from independent verticals or can be setup as holistic view while retaining multidimensional view based on the corporate administrative models.

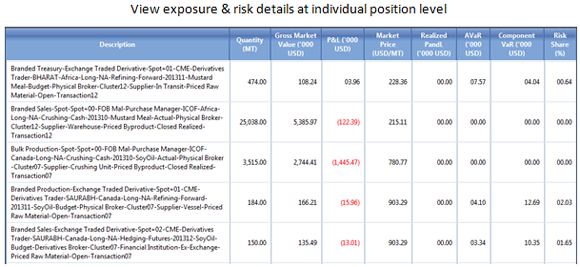

Exposures can be drilled down into only open contracts,

closed & unrealized contracts and closed and realized contracts.

This method of exposure drill down enables clear demarcation of P&L

arising for various business decisions.

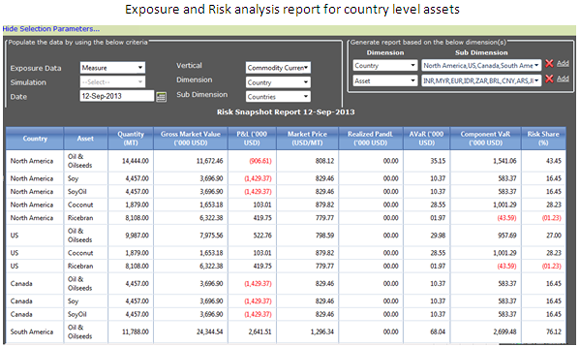

Risk arising from the currencies can be viewed exclusively as a part of a vertical that is completely disjointed or may choose to have combined portfolio from the commodities vertical thereby enabling the distinct viewing and analysis of currency and commodity risks. There will be no need to invest on risk management software separately for currency.

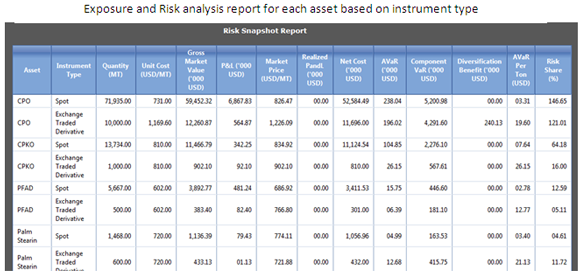

Physical positions hedged in an exchange or over the counter can be grouped together as hedge clusters that can be utilized for any further analysis.

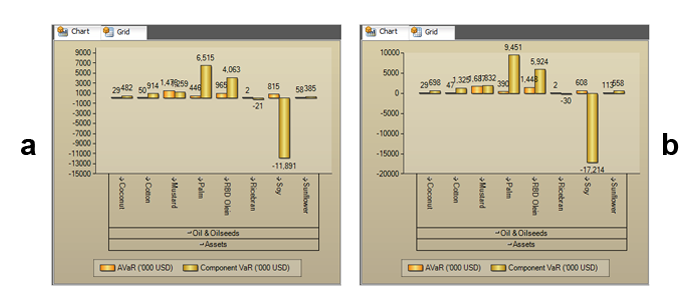

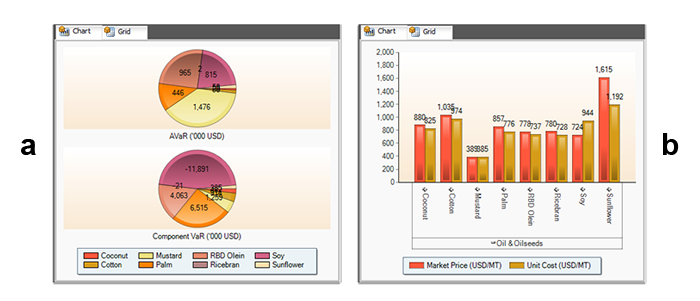

Management Dash Board

A graphical as well as tabular view of the critical reporting aspects in a single shot along with the limit utilization of the generated alerts. A multipurpose dashboard with customization options to suit the never-ending and ever -changing business needs.

|

|

|

|