Features

Features Overview

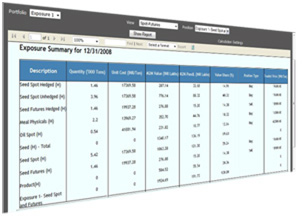

Exposure Analysis

Customized net exposure engine to calculate net exposure based on your business process.

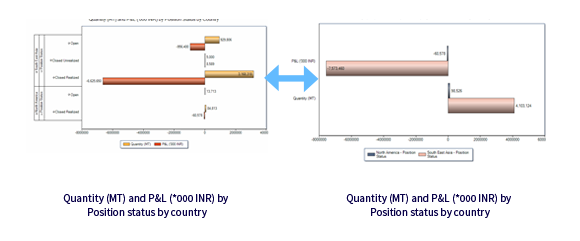

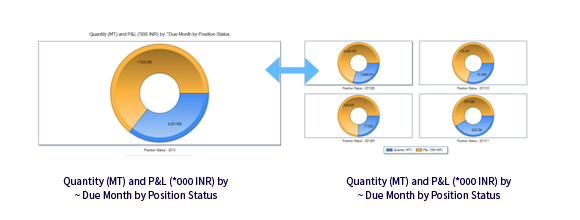

P&L Analysis

Profit & loss can be tracked by open positions, closed positions, shipment wise, cluster wise, transaction wise.

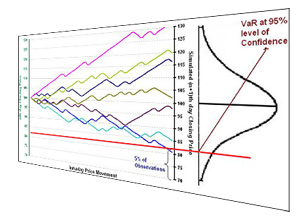

Risk Measurement

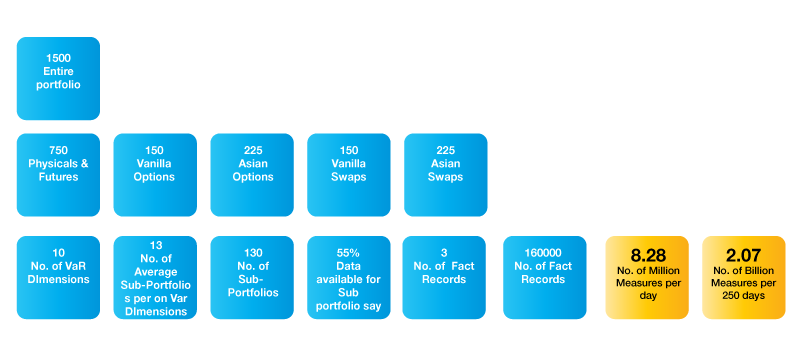

Measure Risk based on Value at Risk (VaR) Framework using Monte-Carlo Simulation, Historical Simulation or Parametric (Variance Covariance) methodologies.

Risk Analysis

Decompose risk to drill-down into position-wise risk and analyse it from multiple dimensions.

Risk Simulation

Simulate various risk calculation and exposure parameters to generate Stress-testing and what-if scenarios.

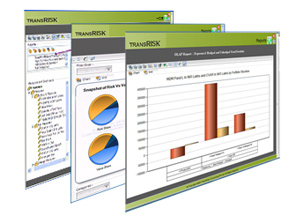

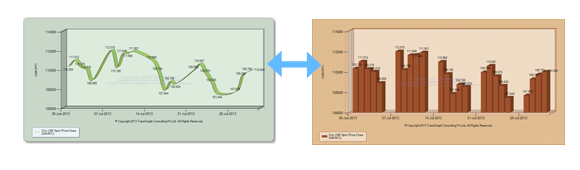

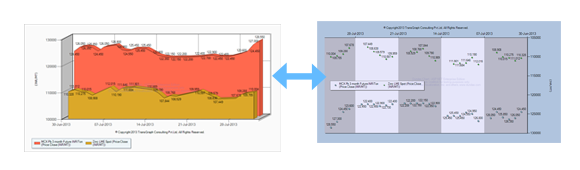

Reports and Graphical Analysis

Highly flexible reporting framework and OLAP (OnLine Analytical Processing) tool allows you to prepare any report and save the format for future use.

Strategy Cockpit

Bird's eye-view of the most useful reports for senior management.

Configurability

Configure custom settings for risk calculation and import / create own price series.

Alerts and Limits

Define internal limits exposures, P&Ls and Risks on traders, commodities, trading desks, positions, markets, etc. and get system generated alerts on limit breaches.

Utility of VaR

Use TransGraph’s Innovative "Imputed Risk Model" for applying VaR numbers to assess the true health of the portfolio.

VaR Algorithms

TransRisk

is a VaR-based Risk Management System. VaR (Value-at-risk) on a

portfolio is the maximum loss we might expect over a given holding or

horizon period, at a given level of confidence (probability). TransRisk

VaR engine is equipped to handle Parametric Approach, Historical

Simulation & Monte Carlo Simulation.

TransRisk

is a VaR-based Risk Management System. VaR (Value-at-risk) on a

portfolio is the maximum loss we might expect over a given holding or

horizon period, at a given level of confidence (probability). TransRisk

VaR engine is equipped to handle Parametric Approach, Historical

Simulation & Monte Carlo Simulation.

VaR

measures like Asset VaR (AVaR), Portfolio VaR (PVaR), Component VaR and

Marginal VaR (MVaR) are also calculated in TransRisk which help to

quantify the contribution of a specific position to the portfolio risk.

Component VaR provides a useful basis for risk capital allocation and

limit setting as it is additive and reflects the benefits of

diversification within a portfolio.

VaR

measures like Asset VaR (AVaR), Portfolio VaR (PVaR), Component VaR and

Marginal VaR (MVaR) are also calculated in TransRisk which help to

quantify the contribution of a specific position to the portfolio risk.

Component VaR provides a useful basis for risk capital allocation and

limit setting as it is additive and reflects the benefits of

diversification within a portfolio.

Wide

range of financial instruments including Options (American, European

& Asian), Swaps (Regular & Average) & exotics like Collars,

Digital, Barrier options etc. are supported in TransRisk for which

pricing and risk calculations are performed. With the availability of an

interactive module in the system for instrument pricing and risk

calculations, traders and commodity consumers can do pre- and post-trade

analytics.

Wide

range of financial instruments including Options (American, European

& Asian), Swaps (Regular & Average) & exotics like Collars,

Digital, Barrier options etc. are supported in TransRisk for which

pricing and risk calculations are performed. With the availability of an

interactive module in the system for instrument pricing and risk

calculations, traders and commodity consumers can do pre- and post-trade

analytics.

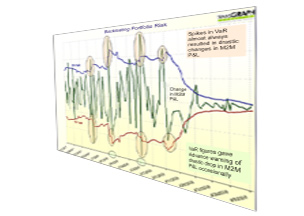

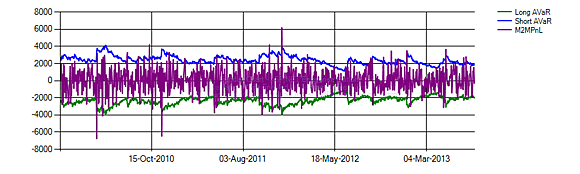

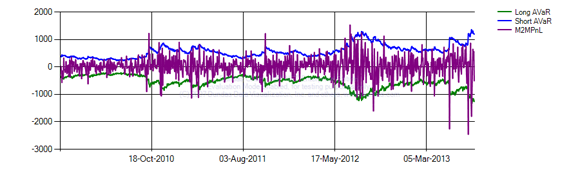

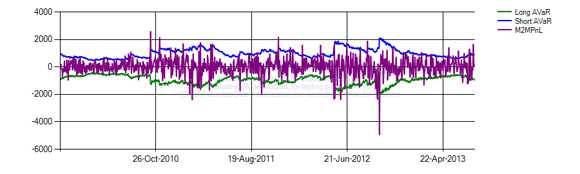

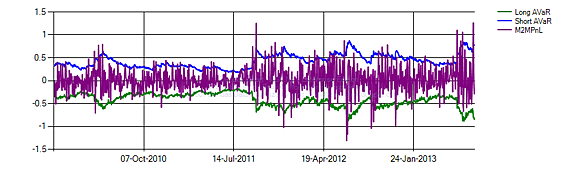

Optimally

designed algorithms ensure quicker computations which results in a much

better system response time. VaR Algorithms have been validated

through backtesting done on various commodities, currencies &

portfolios and forecasted losses were well within the internationally

accepted risk standards.

Optimally

designed algorithms ensure quicker computations which results in a much

better system response time. VaR Algorithms have been validated

through backtesting done on various commodities, currencies &

portfolios and forecasted losses were well within the internationally

accepted risk standards.

| Breach % | Long | Short |

| LME Aluminium 3M Forwards | 4 | 3 |

| CME Soybean futures | 5 | 4 |

| Indonesia CPO Fob | 5 | 4 |

| INR/USD | 4 | 6 |

Data Science

"TransRisk mastered the science of understanding the client position and market price  data

to enable right perspective to the stakeholders in the risk management

process. Be it for a top management, risk department, trading

department, finance department, compliance team, etc TransRisk satisfies

the varied needs of these professionals with its rich Business

Intelligence Layer.

data

to enable right perspective to the stakeholders in the risk management

process. Be it for a top management, risk department, trading

department, finance department, compliance team, etc TransRisk satisfies

the varied needs of these professionals with its rich Business

Intelligence Layer.

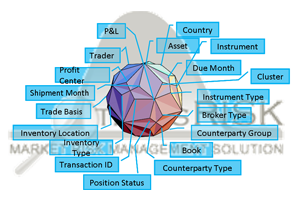

“One Cock Pit System But Multiple Data Dimensions”

“One Cock Pit System But Multiple Data Dimensions”. TransRisk provides flexibility of integrating the position and market price data seamlessly with any ERP / Trading systems and/or a third party data provider or by direct upload using an excel file. TransRisk is powered with robust rules engine which scrutinizes and thereby drops positions with incomplete and invalid information and notifies the users accordingly. Thereby ensures a clean and correct data for further calculations. Transaction level data can be mapped to various price series in order to give flexibility to calculate M2M P&L, Volatility/ Risk differently.

Conversion rules in TransRisk enables covert the data from Commodity Exposure to End product exposure or otherwise as well. Look risk from end product (Ex Auto metal component / Un-hedgable exposure) pricing while monitoring the hedge performance from commodity risk (Ex. steel, copper, aluminium / Hedgable exposure). Convert commodity exposure into end products, by-products and co-products to the exposure more efficiently. Set up the rules for conversion one time, leave regular conversion to TransRisk. It does all these conversions automatically.

The robustness of TransRisk is best utilized when input data is highly granular. Representing a transaction by multiple dimensions will enable greater visibility into the data and thereby the decision making insight. Explore the data from highest portfolio to the lowest transaction level to pin point the riskier positions at varied levels of a portfolio.

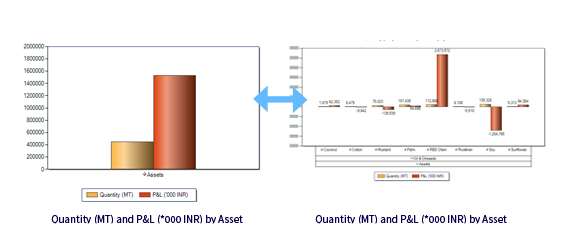

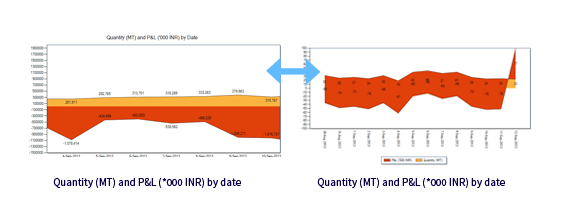

Graphics & Visualization

Analyse various risk reports through use of graphs for understanding the data in historical context over selected period of time. Varieties of choices are available for graphics to help visual aid and presentation of complex trend reports so that they are easy to read. It allows immediately taking data and producing variety of chart types including histograms, 2D and 3D bar charts, pie diagrams and many more. TransRisk provides multiple options to control every aspect of visualizations including axis labels, grid lines, meshes and 3D lighting - allowing you to generate highly customized and professional-quality visualizations.

|

|

|

|

|

|

Productivity & Usability

"Quantification of commodity and currency risk enables the management in comprehending the risk at hand. Visibility into the risk generating denominators among a widely diversified portfolio enables execution of risk mitigation measures. Transparency in viewing reports and alerts ensures alignment between trading and risk control teams. Presence of a web based system accentuates the decision making process by avoiding needless time spent in generating manual reports. A completely workflow based system enables the end users in availing the features with minimum effort.

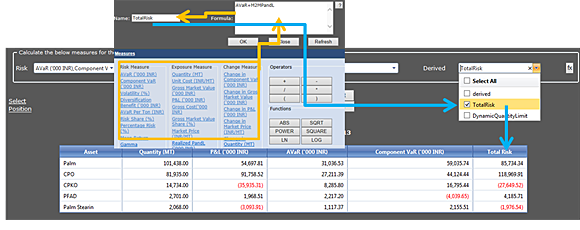

| User Created ‘Derived Measures’ |

|---|

|

A unique feature called 'Derived Measures' enables easy incorporation of any novel parameter specific to a particular business practice without painful efforts on top of the existing measures. This will bring to use such derived measures to decision making process. It all happens while retaining the flexibility on one hand and also following process based system.

"One Company One Risk Culture". Adoptability and adherence to Risk management policy is now process derived through TransRisk across the board.

Notable benefits from TransRisk are

- Business Intelligence and Decision Support Solution

- Single, Accurate view of Exposure

- Risk Management best practices

- Better synchronization between business units

- Reduced operational cost of compliance

- Improved Capital Allocation

- Protect and enhance reputation, Bottom-line and Shareholder Value

|

|

|

| Spreadsheet | TransRisk | |

| Scalability, flexibility & accessibility | Inflexible to cope up with changing business needs; slows down significantly with increasing data size | Browser-based with high security; flexible architecture and reporting framework to accommodate current & future needs with least efforts |

| Active Risk Management | Passive through spreadsheets, users needs to do a lot of ground work before reaching an action point | Limit based alerting mechanism; on multiple dimensions like trader / commodity / division etc. |

| Process automation | Lot of time spent in data input preparation; managing different add-ins through the whole process | Hassle-free imports from transactional systems; automated data management & control process |

| Analysis | Lot of time taken in sifting through loads of data; difficulty in finding out the root causes; difficult to compare & save calculations for different portfolios | Consolidated exposure & risk information; drill-down across dimensions; trend reports; simulations; back testing |

| Auditability & Data Integrity | No intrinsic audit trail; difficulty in tracing issues due to trivial manual errors | audit trail of daily changes / calibrations; validations at multiple stages ensure data integrity |

Functional Framework

Upcoming Features & Functionality

Our risk consultants and development team continue to thrive to improvise the TransRisk utility and applicability. Being long term players in the commodities and currencies over 10+ years, we have envisaged our roadmap further to continue to offer industry appropriate risk solutions. Some of tit-bits are

- Adding more exotic derivatives like extendable swaps, spread options, etc for VaR computations is a continuous journey

- Multiple data source upload from different locations and different times with ERPs and files (.xls/.csv)

- Flexibility to deal with multiple currency pegged positions while retaining the base currency functionality

- Optimize the VaR for real-time computations for high frequency trading entities

- much more...